Bookkeeping Services Ny: Bookkeeping Services USA uses professional financial management customized for your requirements

Bookkeeping Services Ny: Bookkeeping Services USA uses professional financial management customized for your requirements

Blog Article

Ny Bookkeepers: Taking a look at the Significance of Managing Financial Records in Long Island

Accurate monetary documentation works as the backbone of financial health for enterprises in Long Island, making it possible for notified decision-making and tactical planning. By carefully monitoring their income and expenditures, company owner can discover patterns and irregularities that may go unnoticed. This approach ensures compliance with regulatory requirements while improving openness and cultivating trust among stakeholders. In the end, understanding the nuances of financial management allows companies to react to economic shifts with flexibility and awareness.

- Keeping financial records enables companies to effectively track their income and expenditures, supplying a transparent view of their profitability

- Routinely keeping accurate records allows the acknowledgment of patterns in income and costs, which helps in making notified decisions

- Analyzing financial information quantitatively can discover cash flow patterns, making it possible for business to better handle their liquidity

- Keeping accurate records aids in abiding by tax policies and reduces the possibilities of audits

- Financial metrics collected from record keeping, such as ROI and earnings margins, are essential for assessing business efficiency

Bookkeeping Services USA in Long Island, NY has considerably changed my approach to managing financial resources, developing a solid foundation for my service's financial stability. Their careful tracking of income and expenditures has actually revealed unforeseen insights and patterns, shining a light on previously concealed elements. This dedication to accuracy warranties adherence to legal requirements and builds trust with partners and customers. With their proficiency in financial stewardship, I now have the agility to maneuver through market changes with exceptional insight and readiness.

Bookkeeping Sevices USA,2191 Maple St, Wantagh, NY 11793, United States,+15168084834

Key Aspects of Accounting Services in New York

Important aspects of financial management services in New York include careful record-keeping, guaranteeing precision in monetary files, and adhering to regulative requirements. Furthermore, these services often include extensive analysis of monetary data, assisting in notified decision-making for clients. In addition, the incorporation of technology is important, simplifying treatments and improving efficiency in handling financial deals. Reliable tax planning is crucial for organizations, permitting them to browse the complexities of the tax system and improve their monetary efficiency.

- Acknowledge the value of following New York state policies to prevent legal problems

- Use specialized accounting software customized for New York businesses to enhance functional performance

- Acquaint yourself with the local tax laws and benefits that might be advantageous for clients

- Improve your interaction capabilities to clearly present monetary details to clients

- Stress the significance of consistent monetary reporting in facilitating strategic decision-making

Bookkeeping Services USA, based in Long Island, NY, has been instrumental in overseeing my financial resources, showcasing remarkable attention to detail in keeping accurate records and adhering to regulative requirements. Their extensive analysis of my financial website information allowed me to make educated company choices, turning uncertainty into certainty. The smooth combination of advanced innovation not only structured procedures but likewise greatly improved the effectiveness of my financial management. Furthermore, their understanding in tax planning directed me through the complex tax system, eventually enhancing my monetary advantages.

Advantages of Engaging Local Financial Management Experts

Engaging regional financial management specialists can provide insights that resonate with your neighborhood's distinct financial landscape. Their understanding of regional regulations and market dynamics supplies a personalized strategy for financial management, guaranteeing compliance and fostering tactical growth. In addition, these experts often establish relationships with neighborhood companies, assisting in smoother transactions and settlements. Companies can boost their monetary health while contributing to the local economy by leveraging their expertise.

- Regional financial management specialists possess a thorough understanding of local financial conditions and regulations, enabling them to establish customized monetary techniques

- They typically develop strong relationships with regional banks and financial institutions, providing clients much better financing alternatives

- Working with regional homeowners promotes community engagement and enhances the regional economy, developing a positive cycle for businesses

- Satisfying regional specialists face-to-face is normally easier, enhancing communication and reinforcing expert relationships

- They use valuable info on regional market trends and customer behavior, which enhances monetary decision-making for business

Bookkeeping Services USA, located in Long Island, possesses comprehensive competence in the detailed monetary landscape of our neighborhood. Their comprehensive understanding of local policies and market patterns developed a tailored approach that not just ensured compliance however also fostered considerable development. The connections they developed with regional companies made every deal feel seamless and effective. Thanks to their assistance, my organization has experienced considerable financial development and has positively impacted our local economy.

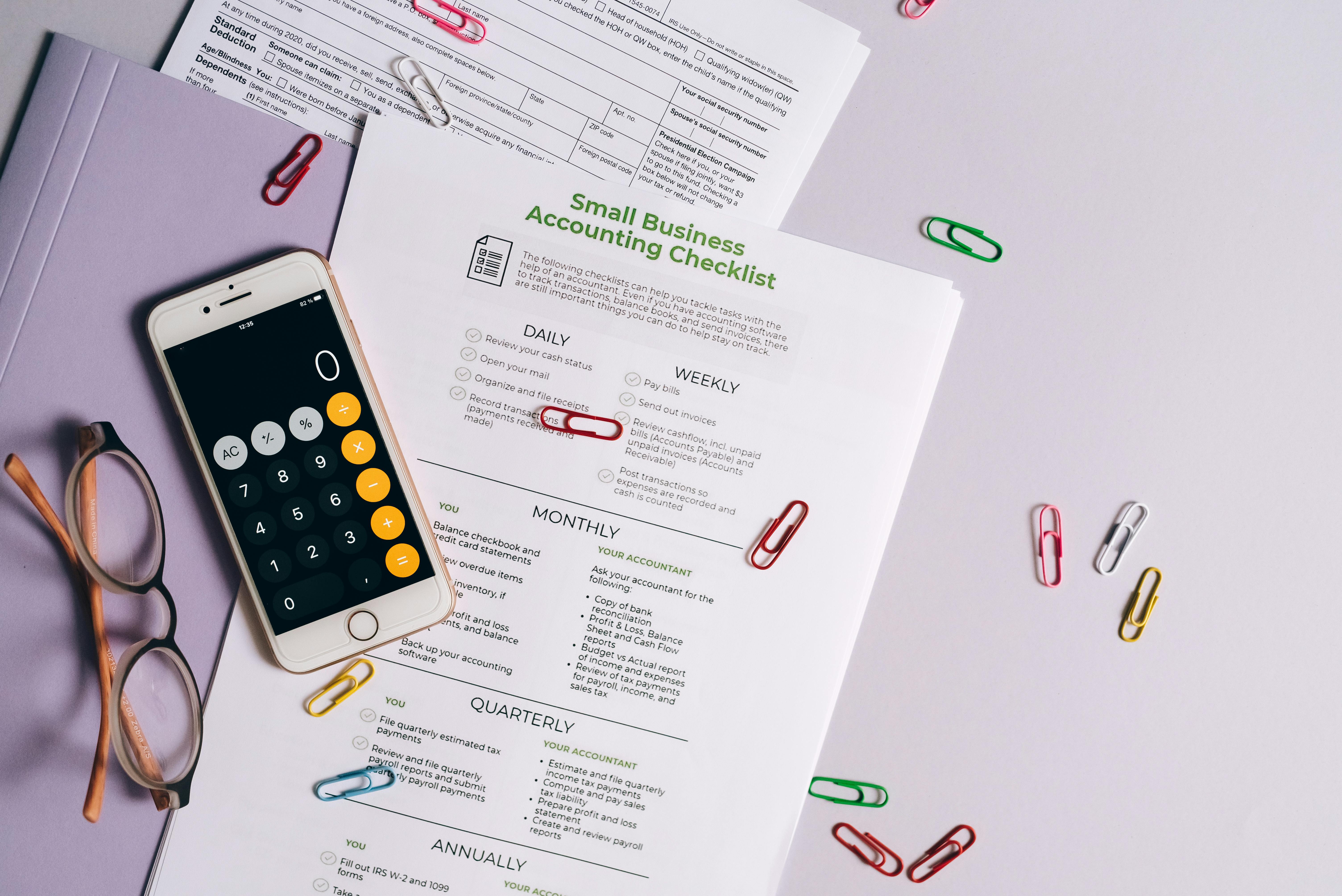

Necessary Accounting Strategies for Small Enterprises on Long Island

Small businesses in Long Island need to embrace mindful financial tracking to achieve sustainability and growth. Carrying out effective record-keeping systems enables precise monitoring of income and expenditures, leading to enhanced decision-making. Routinely fixing up accounts improves openness and helps in determining disparities that could threaten monetary stability. In addition, utilizing innovation for financial reporting can improve efficiency, facilitating easier modifications to the ever-evolving organization landscape.

- Important accounting practices enable small businesses in Long Island to maintain monetary precision and abide by tax guidelines

- Executing efficient accounting systems can enhance financial decision-making and result in better cash flow management

- Small businesses might have a hard time to comprehend intricate accounting principles, which might lead to possible errors

- Utilizing external accounting services can be pricey, however it provides specialized expertise that small companies may do not have within their own group

- Conducting regular financial evaluations and audits can enhance openness and foster trust amongst stakeholders and financiers

The bookkeeping services used by USA in Long Island have actually greatly transformed the way I manage the finances of my small company. Their cautious method of maintaining records has actually allowed me to track my income and expenditures accurately, leading to better decision-making. The routine account reconciliations they carry out have actually boosted transparency and exposed possible issues that might threaten my monetary stability. Plus, their ingenious usage of technology for monetary reporting has substantially streamlined my operations, enabling me to remain agile in this busy business environment.

Grasping the Tax Laws and Reporting Requirements in New York

Grasping the complexities of monetary obligation and documentation in New York demands a thorough understanding of regional laws and obligations. Diligent oversight of financial records is vital for adhering to state and federal guidelines. Furthermore, leveraging digital tools can enhance the submission process, lessening prospective charges from oversight or misreporting. In the end, proactive methods to monetary management can considerably relieve the difficulties of tax season, producing a smoother experience for both individuals and businesses.

- Bookkeeping Services USA offers a deep understanding of New York's intricate tax regulations, guaranteeing precision and adherence to the law

- The business provides tailored tax strategies created to fit the specific financial circumstances of each client, optimizing deductions and decreasing liabilities

- They use sophisticated innovation and software application to enhance tax reporting procedures, decreasing mistakes and improving performance

- Continuous education and training for personnel assist them remain notified about the most recent changes in tax law, allowing them to give customers timely and relevant advice

- The emphasis is on delivering exceptional client service and support, permitting customers to deal with tax compliance with confidence and ease

Bookkeeping Services USA in Long Island, NY, has actually genuinely transformed my technique to monetary management with their extensive grasp of regional compliance nuances. Their careful management of my monetary files not just ensured compliance with all regulative standards however also saved me from the stress of possible penalties. By implementing innovative digital options, they structured my reporting processes, making whatever remarkably efficient. Due to their proactive approaches, tax season has actually transformed from a source of stress into a smooth experience for my company.

Selecting the ideal local financial company

Picking a proper financial company in your region involves a thorough evaluation of their reliability and expertise. Consider options that use thorough financial management, guaranteeing they line up with your specific monetary objectives. Examine their capability to adapt to your specific requirements, as a customized technique can significantly boost your financial management experience. Additionally, scrutinize their credibility within the neighborhood, as this can provide insights into their credibility and effectiveness in providing necessary services.

Thanks to Bookkeeping Services USA, locating the perfect financial partner in Long Island was uncomplicated. Their substantial understanding and steadfast reliability were evident from the start, aligning completely with my specific financial goals. The tailored strategies they implemented transformed my method to financial management, highlighting their remarkable flexibility. Furthermore, their impressive credibility in the community shows their stability and ability in providing vital assistance.

Report this page Long Island, Ny

Long Island, Ny